Early retirement was our goal when we started following Your Money or Your Life. With the addition of this last piece we were able to retire in our fifties. If we had started earlier I’m sure we could have retired earlier. It is not too late for you to try this approach, nor too early.

The last big piece of the puzzle is tracking your spending. We created a Google sheet in the middle of 2010 for that year’s spending. We found it so easy and enlightening that we have tracked ever since.

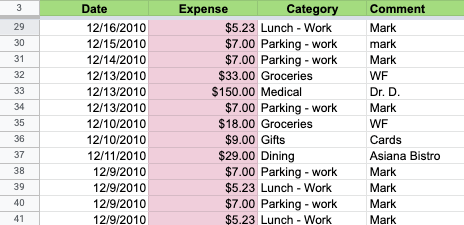

Here is a little snippet from December 2010. The only semi-large expense is the Medical one. The rest of them are so small that they are forgettable:

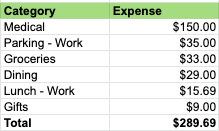

If you sum up those expenses, it is surprising to see that the second biggest expense was parking for work. Spending just $7 per day adds up.

The first benefit of tracking is we figured out where all our money went. There are the big, obvious things like the mortgage or car repair bill. Then there are all the small things that seem like nothing but they add up to a large chunk of spending each month.

The second benefit is we could look at the data at the end of the month and decide whether we were happy with how much we spent in each category. If not, what could we do about it? Paying for work parking may not be optional, but buying lunch every day is. We didn’t do this review every month, not even close. But every once in a while, when we got the feeling we were being loose with our spending, we’d take another look. The book goes into this process in much more detail.

The third benefit is these sheets have become a helpful record we can refer back to. When did we remodel the bathroom? When did we last get the oil burner serviced? Who did I buy mulch from last year? It’s all in there.

Of course the biggest benefit is these sheets enabled us to retire early. We wasted less money and saved more, building our net worth. We understood exactly how much we needed to have a fun and comfortable retirement. Without the resources and the knowledge we would not have pulled the plug on work.

We’ve refined our spreadsheet over the years. The categories have evolved with our interests (hello “Dog” and “Guitar”, goodbye “Wine Making”). Each month we copy a list of recurring expenses to the new month. We have a summary tab that calculates monthly totals and averages.

Tracking your spending does not need to be complicated. You can use pen and paper or something online. We love Google Sheets because it is shared, accessible from anywhere, and easy to categorize and create formulas. Using the app to add expenses as they occur is easy.

The hardest thing is getting started and making it a habit. If you have dreams of being able to quit your job and spend your time how you’d like, it is a habit worth cultivating.

Read all the articles related to Your Money or Your Life:

- How Much Time Does Your Job Cost You?

- How Much Money Does Your Job Cost You?

- How Much is Your Stuff Worth?

- Where is Your Money Going? (this article)